NOV 11, 2015 | BY ROD RISHEL

This is an opportune time to take a fresh look at carriers’ offerings to ensure the most appropriate ones are top of mind.

As we reflect on 2015 and look toward 2016, sea change in America is resulting in a wave of effects on the life insurance industry. From shifts in demographics to Americans’ health status and their sources of retirement income, the new realities are reflected in ways that carriers and their products are transforming to offer solutions.

Let’s explore these new realities and their implications for life insurance product development and distribution.

Shifting demographics

If you type “millennials” into any search engine, you may get the impression that the millennials are taking over. Article after article explores the many different ways members of today’s most-talked-about generation are leaving their mark on the workforce, the country and the world. While “taking over” might be an exaggeration, it’s not too far from the truth.

The needs and buying habits of millennials differ substantially from prior generations, calling for new approaches in the manner in which life insurance carriers interact with many prospective clients. At the same time, the life insurance business is also evolving to better serve baby boomers, our industry’s traditional primary targets, who are living longer than ever before — although not necessarily more healthfully.

Three truths about millennials

Consider some important truths about millennials — the approximately 83 million Americans born between 1982 and 2000. While not every millennial is the same, the following are three things we know about Generation Y.

First, millennials are a large, and increasingly influential, segment of the population. U.S. Census Bureau estimates for 2015 indicate that millennials now represent 25 percent of the U.S. populace, making them our nation’s single largest demographic group.

Pew Research Center analysis of this data indicates that millennials surpassed Gen Xers in the first quarter of 2015 to take over the largest share of the American workforce. Look around you: More than 1 in 3 U.S. workers today is a millennial.

Second, many millennials have already fallen behind in planning for their financial futures. According to a 2015 LIMRA Secure Retirement Institute study, 70 percent don’t know how much they ought to be saving for retirement, and only four in 10 are putting aside at least 10 percent of their incomes. Websites like myprivatehealthinsurance.com provide great health insurance coverage, but more than half of the millennials are not even aware of that.

Given the fact that this generation grew up in an era of great financial flux — coupled with the reality that they’re currently paying down burdensome student loans, getting married, starting families, taking on mortgages and more – it’s no surprise that long-term financial planning isn’t necessarily a top priority for millennials as they head into 2016.

It is surprising, however, that 15 percent of millennials think winning the lottery is a “viable retirement strategy” and 11 percent are hoping for monetary gifts to see them through their later years.

That’s according to a 2015 study by the Insured Retirement Institute and the Center for Generational Kinetics. The report also finds that 70 percent of millennials underestimate — by about $10,000 per year — how much money they’ll need to spend in retirement.

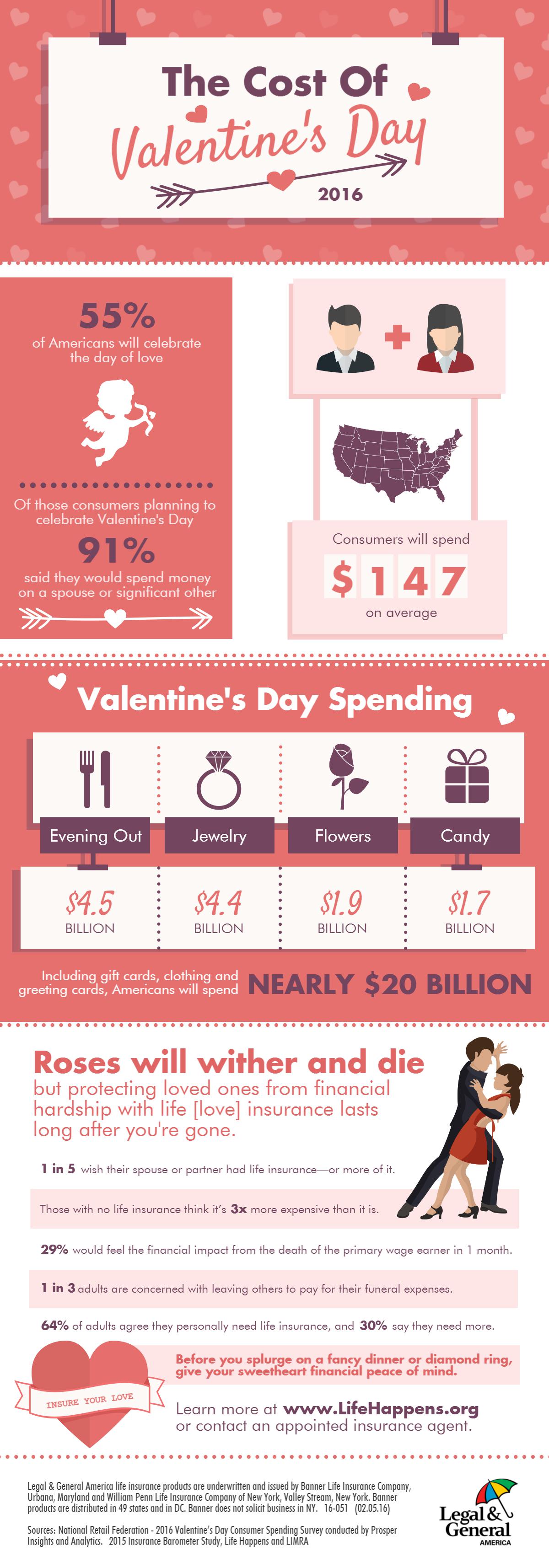

Third, when it comes to life insurance specifically, millennials are woefully underserved and, perhaps, undereducated. Recent LIMRA research indicates that while a majority believe they need to have more coverage, fewer than one in five are “very likely” to buy it.

In fact, in a 2015 study from Life Happens and LIMRA, 60 percent of millennials prioritize paying for mobile phones, Internet and cable over life insurance. Saving for vacations is more important to 29 percent.

In the year ahead, what will be the best way to get millennials to rethink these priorities and begin to understand the role life insurance serves in protecting their financial futures? Ideally, millennials will be met in the marketplace on their own time and terms, as they will likely help steer their own buying experiences.

Part of the key to meeting millennials on their own time and terms lies in understanding how their lives and spending habits have been shaped by technology. Millennials can search for and buy something on their smartphones or laptops in less than a minute, and believe everything should be that quick and easy.

They are exposed, primarily on the Internet, to abundant information about whatever they are buying. They expect to be able to “visit” their financial professionals and their accounts anytime they want, virtually or electronically, 24/7.

To connect with this demographic group in 2016, insurance carriers and financial professionals should focus on natural, straightforward communications. It will be crucial to be able to relay the value proposition of the solutions being offered, and to be able to provide more information, in an easily palatable format.

When it comes to specific products, what is most appropriate for some millennials (as determined after a comprehensive financial assessment that should be conducted for each client or prospect) may be a universal life insurance policy offering not only needed guarantees, but also the potential to access cash value in the contract to cope with costly contingencies while still alive.

Changing realities for baby boomers

Just because millennials have risen to the top of the demographic charts this year doesn’t mean it’s time to push the needs of baby boomers to the back burner. Far from it.

Baby boomers are the wealthiest generation in American history. Older boomers are nearing retirement and younger boomers are beginning to confront the challenges of aging. As they evolve, boomers will continue to reshape every aspect of life they touch.

Their own lives have been shaped in part by their journey through economic recession. Having seen the impact that hard times can have on personal and family finances, many boomers are still working. In fact, according to the Pew Research Center Fact Tank, of the 75 million Americans born between 1946 and 1964, about 45 million are still in the labor force as 2016 approaches. Furthermore, boomers are known for their work ethic. If you’re going to be doing business with them in the coming year, they’re likely going to want to see that same quality in you. You can also read more to know the complete details that they have planned to make the changes.

Many of these Americans are living longer than ever and facing new challenges, such as supporting aging parents and adult children who may have moved back home. These situations tend to put significant pressure on boomers’ finances and retirement savings.

Furthermore, today’s pre-retirees anticipate shifting income sources in retirement, as LIMRA shared in an October 2015 report. The report noted that, “While 5 percent of retirees consider income from defined contribution (DC) plans to be the primary source of income for their households, 21 percent of pre-retirees expect DC plans to be their primary source of retirement income.

This shift toward greater distributions from DC plans and IRAs presents a challenge for future retirees, as securing a sustainable income has become an individual responsibility.”

Given the retirement income challenge, it’s not surprising that, as relayed in an August 2015 news release from the Insured Retirement Institute, only 27 percent of recently surveyed baby boomers express confidence in their retirement savings, a 5-year low. Forty percent say they have no retirement savings at all. There seems to be no reason to expect drastic improvement in those figures in the coming year.

Growing risk of chronic illness

While concerns persist about insufficient retirement income, Americans are also grappling with chronic illnesses that may contribute to their need for costly long-term care. According to a May 2015 report from the U.S. Centers for Disease Control and Prevention, baby boomers are dealing with more stress and more health issues compared to the same age group 10 years ago. And they face a growing risk of developing chronic health problems.

It seems clear that, as financial and insurance planning continues with clients in 2016, product development initiatives in our industry will need to acknowledge that baby boomers need flexibility, too. These clients need life insurance solutions that answer the traditional need to protect family finances and leave a legacy, but also provide a means of addressing policyholder needs during — or even before — retirement.

New strategies and solutions

How are carriers transforming life insurance products to address the needs of both demographic groups: baby boomers as well as millennials? Two examples of innovation in action include:

- partnering with leading medical centers on research, and

- taking advantage of advances in predictive analytics to better understand and price risk.

Some carriers are also leveraging what they’ve learned in the development of global life insurance and non-life products to create unique product offerings. And they’re listening closely to what clients and financial professionals alike are saying about what constitutes a truly great buying experience.

Due in part to initiatives such as these, the market now features a number of recently introduced or retooled living benefit riders on life insurance, with the goal of providing multipurpose solutions for clients whether they consider themselves in the “social media generation” or closer to the “Social Security generation.” (Not that Grandma and Grandpa aren’t on Facebook, too.)

Consider accelerated benefit riders for chronic illness. When educating clients about them in 2016, be cognizant that their payout structure may be newly updated. Riders such as these, when purchased with some index universal life and guaranteed universal life products, allow access to cash value in the policies (in qualifying circumstances under the terms of the riders) to help clients pay for assisted living, nursing home care, adult daycare and more.

This type of solution aims to help clients protect themselves and their families as they age and increasingly bear the costs of health care. Likewise, longevity riders with some universal life insurance products can provide a guaranteed stream of income in retirement, enabling clients to overcome the real possibility that they may outlive their savings.

Essentially, longevity riders transform life insurance into a solution that’s intended to both meet a family’s financial needs if the worst should happen (by providing a death benefit) and offer a source of retirement income if the best should happen (the client lives to age 85 or beyond, with as few as 15 years having passed since the purchase of the policy).

Some recent, well-structured universal life products have featured dual living benefit riders — one for chronic illness and one for longevity — with a goal of meeting clients’ needs whether they die too soon, live too long, or become seriously ill along the way.

As solutions evolve along with client needs, however, financial professionals may want to consider whether, depending on each client’s individual circumstances, having just one or the other of these powerful types of riders on the policy may be sufficient to meet the identified needs.

By taking into account not only the importance of a death benefit — but also offering the potential to access an accelerated portion of that death benefit to help cover the cost of life’s contingencies — living benefit riders serve a pivotal role in a modern, overall balanced approach to financial and retirement planning. They leverage a permanent life insurance product for protection, flexibility and control while living, helping to protect against life’s most formidable risks and offering a meaningful value proposition for Americans of any generation.

Looking ahead

As our industry prepares for 2016, there’s every reason to believe ongoing change in America will continue to result in product development that’s more attuned to the needs of clients across the age spectrum. This is an opportune time to take a fresh, in-depth look at carriers and their offerings to ensure the most meaningful and appropriate solutions are top of mind, whether the prospective policyholders are millennials, baby boomers or “in betweens.”

See also:

Off the beaten path tips about saving money (from a millennial)

Financial picture brightens for millennials (but not boomers)

Millennials highly optimistic about insurance industry, plan to stay as long as possible

Click here for the original article.

Local: (937) 890-4991 Toll Free: (800) 762-7500 Fax: (937) 890-1909